Asian Cosmetic Market: New Challenges and Opportunities

Founder of UKPACK, Chief Packaging Designer with 18 years of experience, Red Dot Award Winner

Specialize in custom, innovative, and sustainable packaging solutions for cosmetics, skincare, personal care, hair care, food and beverage, and more.

- ಏಷ್ಯನ್ ಕಾಸ್ಮೆಟಿಕ್ ಮಾರುಕಟ್ಟೆ ಪ್ರವೃತ್ತಿಗಳು

- ಏಷ್ಯಾದಲ್ಲಿ ಪ್ರಬುದ್ಧ ಮತ್ತು ಉದಯೋನ್ಮುಖ ಕಾಸ್ಮೆಟಿಕ್ ಮಾರುಕಟ್ಟೆಗಳ ನಡುವಿನ ವ್ಯತ್ಯಾಸಗಳು

- ಏಷ್ಯಾದ ಸೌಂದರ್ಯವರ್ಧಕ ಮಾರುಕಟ್ಟೆಯ ಬೆಳವಣಿಗೆಯನ್ನು ಪ್ರೇರೇಪಿಸುವ ಉದ್ಯಮದ ಪ್ರವೃತ್ತಿಗಳು

- ಏಷ್ಯಾದ ಕಾಸ್ಮೆಟಿಕ್ ಉದ್ಯಮದಲ್ಲಿ ಬ್ರ್ಯಾಂಡಿಂಗ್ನ ಕಾರ್ಯತಂತ್ರದ ಪಾತ್ರ

- ಮುಂದಿನ ದಶಕದಲ್ಲಿ ಏಷ್ಯನ್ ಕಾಸ್ಮೆಟಿಕ್ ಉದ್ಯಮಕ್ಕೆ ಸವಾಲುಗಳು

- ತೀರ್ಮಾನ

- UKPACK ಹೇಗೆ ಸಹಾಯ ಮಾಡಬಹುದು

The beauty landscape in Asia is undergoing a remarkable transformation, with the Asian cosmetic market standing at the forefront of global trends. From historical developments to current challenges and future opportunities, this article delves into the intricacies of the industry, offering insights into the dynamic world of Asian beauty.

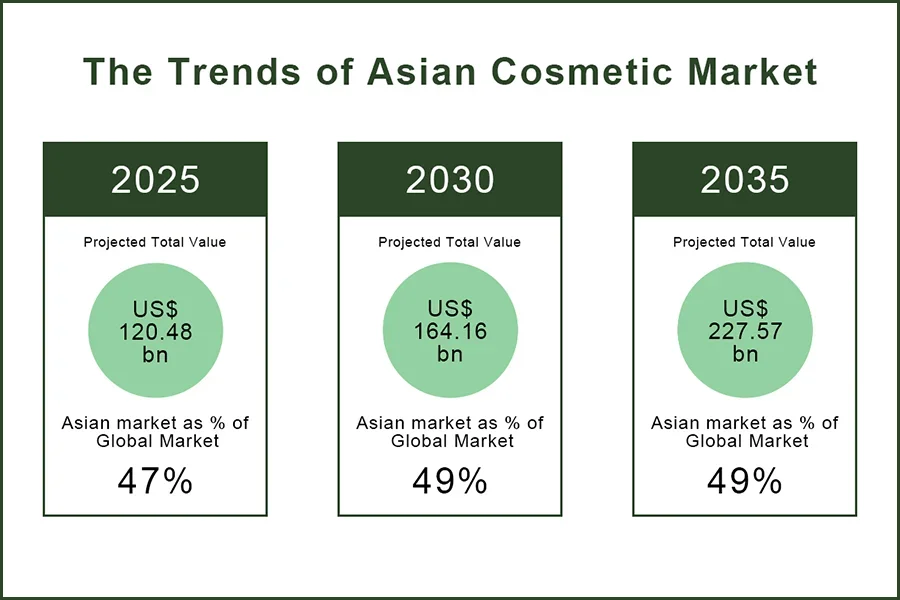

Asian Cosmetic Market Trends

According to the report, the Asian cosmetic market is on a robust growth trajectory, with revenue expected to soar to US$244.40 billion by 2023, demonstrating an annual growth rate of 3.54% (CAGR 2023-2028). Looking ahead, the strategic significance of Asia in the cosmetic industry becomes even more pronounced, with projections estimating a market value of around US$227 billion by 2035. This forecast is accompanied by an anticipated Compound Annual Growth Rate (CAGR) of 5.84% from 2021 to 2035. Beyond being a significant consumer of beauty products, Asia has evolved into a hotbed of innovation, notably contributing to the global beauty landscape through trends like K-Beauty from Korea and more recently, J-Beauty from Japan.

The Differences Between Mature and Emerging Cosmetic Markets in Asia

Asian consumer markets are very complex and diverse. Mature and emerging markets have distinct features. We need to look at multiple factors to analyze growth in Asia’s beauty industry.

Mature Markets

- Hong Kong and Singapore: $2.5 – 3 billion markets, mostly driven by non-local traffic, with low single-digit growth.

- South Korea: Known as the “beauty queen of Asia,” total market value is $7 billion with 4% predicted growth. Well-known brands include Amorepacific, Dr.jart+, and Sulwasoo.

- Japan: Total market size is $12.5 billion, with big players like Shiseido and Kanebo. However growth is slowing at low single digits.

Emerging Markets

- Malaysia and Indonesia: Malaysia has the fastest growth at 10%, while Indonesia grows at 6%. Halal cosmetics present big opportunities in both markets.

- China: The massive personal care market in China is valued over $50 billion and continues growing at around 7% each year.

First, the rising middle class is happening across Asia, especially in China where it makes up over 50% of the total population. More spending power will drive beauty consumption.

Also, the internet allows Asian customers to discover and try new brands. Studies show Chinese shoppers now have 8-9 brand touchpoints on average before purchase, much higher than the 5-6 in Western countries. This creates new marketing opportunities.

Finally, Asians actively focus on health and wellness. This also rapidly increased Asia’s global cosmetics market share. The wellness and beauty industry certainly is growing quickly.

In summary, huge potential still exists in China and Asia overall. Companies wanting to seize opportunities must study these unique consumer groups and develop tailored competitive strategies.

Industry Trends Driving Asia’s Cosmetic Market Growth

First, demand for skincare is rising because of increased skin problems caused by pollution and lifestyle stress. Asian skincare routines are complex, often involving multiple products.

Second, emerging giants like China are disrupting old industry rules. Brands like Perfect Diary used innovative business models for rapid growth. Independent brands like Pechoin also gained popularity.

Additionally, the Asian beauty market is still a blue ocean compared to Western brands without dominant players. This gives opportunities for smaller companies with distinct positioning and competitive products.

Finally, collective culture means Asian consumers value mass approval more. Partnerships with established domestic brands or influencers can therefore quickly gain new brands recognition.

The Strategic Role of Branding in Asia’s Cosmetic Industry

Branding plays a vital role in Asia’s beauty industry and will continue to do so. Asian consumers highly value brands when purchasing beauty products – this is the branding effect. In addition to brand building, leveraging celebrity resources also directly impacts sales performance.

Take Procter & Gamble’s SK-II for example. It continues hiring top celebrities across Asian markets as brand ambassadors, like Chinese actress Tang Yan, significantly enhancing local brand awareness and reputation. Meanwhile, homegrown brands like Perfect Diary use influencer livestreaming to gain a loyal customer base.

In recent years, several emerging Korean beauty brands have quickly risen in Asia through quality products and celebrity resources, indicating consumers now look at the products themselves, not just packaging.

Ultimately, competition comes down to products and communication. Brands that innovatively develop products and find the best fits to reach their target consumers will ride the wave. This is the rule of our appearance-centric era.

Challenges for the Asian Cosmetic Industry in the Next Decade

Behind all the flashy packaging, celebrity ads and heavy marketing, Asian beauty companies need to be aware of long-term challenges ahead. The most important one is the rise of knowledgeable, discerning and critical local consumers. They can no longer be attracted by cheap French perfumes or American skincare. Instead, more Western brands are now looking to Asian beauty traditions for new ideas and customized products.

Take the Korean-French brand Erborian for example. Founded by a Korean scientist and a French expert, it aims to share Korea’s beauty secrets with the world. Erborian combines Korean pharmaceutical knowledge, quality ingredients, advanced techniques and French aesthetic style. Editors of famous fashion magazines have said that the dedication of Asian women to beauty helps inspire innovations in Asian cosmetics as well as more and more global brands.

Impact of Social Changes

Brands must realize that consumers demand not just good products, but personalized service. This may sound contradictory to the appeal of celebrity spokespersons, but the two are not mutually exclusive. While Asian women admire pop icons, their focus on individual needs and choices keeps growing and gaining acceptance too. In this community-oriented region, personal expression also deserves full respect. Beauty brands need to strike a balance between catering to celebrity fever and meeting needs for customization.

Definitions of “beauty” are important tools for building and maintaining social status for many.

Social changes and lifestyle shifts deeply affect usage and purchase of cosmetics. Asian societies are undergoing such transformations. Per Morgan Stanley analysis, the rise of e-commerce has greatly altered how Chinese consumers buy beauty items. Instead of mainly state-owned shops in the past, now consumers can choose globalized products from more local retailers, or find more online options with mobile apps. Brand sales channels have undergone dramatic changes.

With rising incomes and easy access to reputable global brands, Chinese consumers crave more premium cosmetics and increasingly shop on overseas platforms.

Impacts of Multifaceted External Factors

In addition to social factors, changes in lifestyles, new health and wellness trends, environmental changes and a growing need for convenience are influencing beauty habits and practices. These changes directly impact brands and their innovation. To succeed in Asian markets, brands need to design products suited to local consumer tastes instead of just importing them. This applies whether the brands are multinationals or local companies.

Unraveling the Asian Cosmetic Consumer

Take companies like Procter & Gamble, L’Oreal and Estee Lauder as examples. Their success in Asia is driven by developing and launching products meant for Asian consumers. SK-II by P&G is a skincare brand designed for Asian women. With increasing demand for natural and organic products, consumers are also increasingly concerned about where ingredients come from, their purity and how products are made. These factors greatly influence companies’ innovation strategies. In short, understanding and catering to Asian consumers is key for foreign and local brands’ success in this market.

Keeping Up with Changing Beauty Standards

In addition to multinationals adjusting their global strategies or making new ones, local brands also face the challenge of shaping brand images that align with contemporary aesthetics and notions of “beauty”. As people’s awareness and empowerment grow, long-standing accepted definitions of beauty will be overturned. For example, the traditional Asian belief that “lighter skin is more beautiful” is being questioned. Brands need to respond by keeping up with the times and adapting to consumers’ updating aesthetics and definitions of “beauty”. In short, whether international corporations or local brands, they must stay relevant by having their brand images reflect the diversity of modern perspectives on beauty.

Conclusion

The Asian cosmetics industry is undergoing rapid expansion and transformation. Driven by rising incomes, increasing health awareness, and changing lifestyles, Asian markets present massive opportunities as well as challenges. Companies must keep pace with evolving consumer demands and definitions of beauty, while also adapting branding and marketing strategies to Asian tastes.

Ultimately, success in Asia’s dynamic beauty industry depends on understanding multifaceted Asian consumers and relentlessly innovating to serve their needs. Companies that can balance celebrity influence with personal customization, while blending globalized products with localized traditions, will be best positioned to capitalize on this $244 billion market. As consumption continues climbing, the Asian cosmetics sector seems poised to lead beauty industry growth for decades to come.

How UKPACK Can Help

UKPACK is a leading beauty packaging supplier, specialized in providing innovative and top-quality packaging solutions for the beauty and cosmetic sector.